The Problem

The Affordable Care Act (ACA) has helped individuals with pre-existing conditions like cancer access comprehensive health insurance and afford their care. But the law is at risk of being dismantled. The risks of losing ACA protections are clear when you look at current plans that do not have to play by ACA rules. Short-term limited duration plans often attract enrollees with low premiums, but they don’t cover all the services patients need and come with annual limits on benefits or other unwelcomed surprises like excluding coverage for a cancer diagnosis as a ‘pre-existing condition.’ For patients with cancer, this can lead to astronomical costs and difficulty affording care.

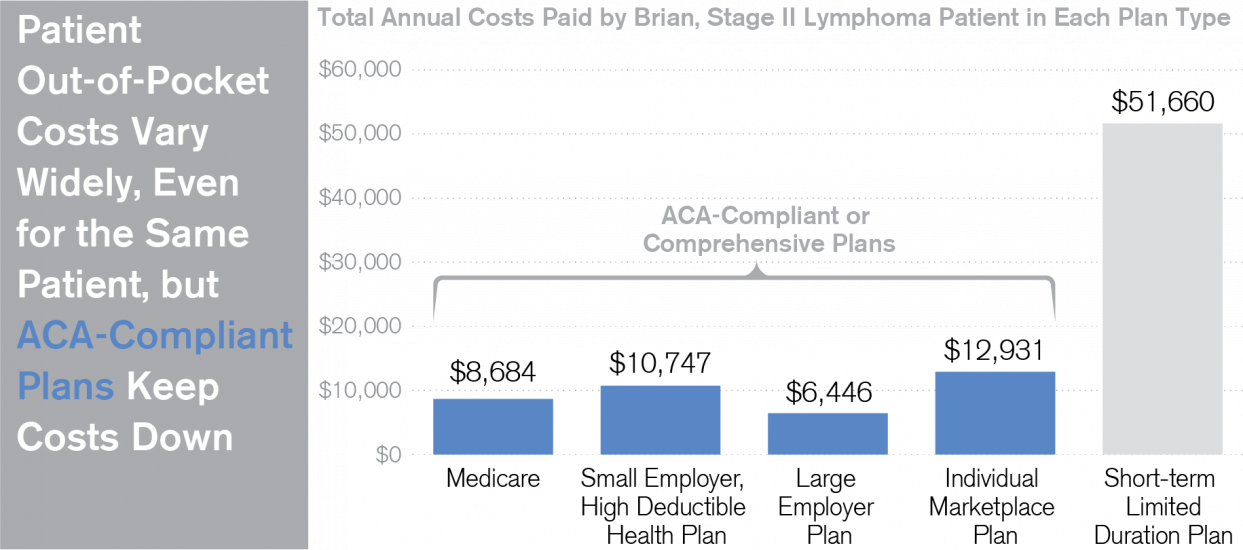

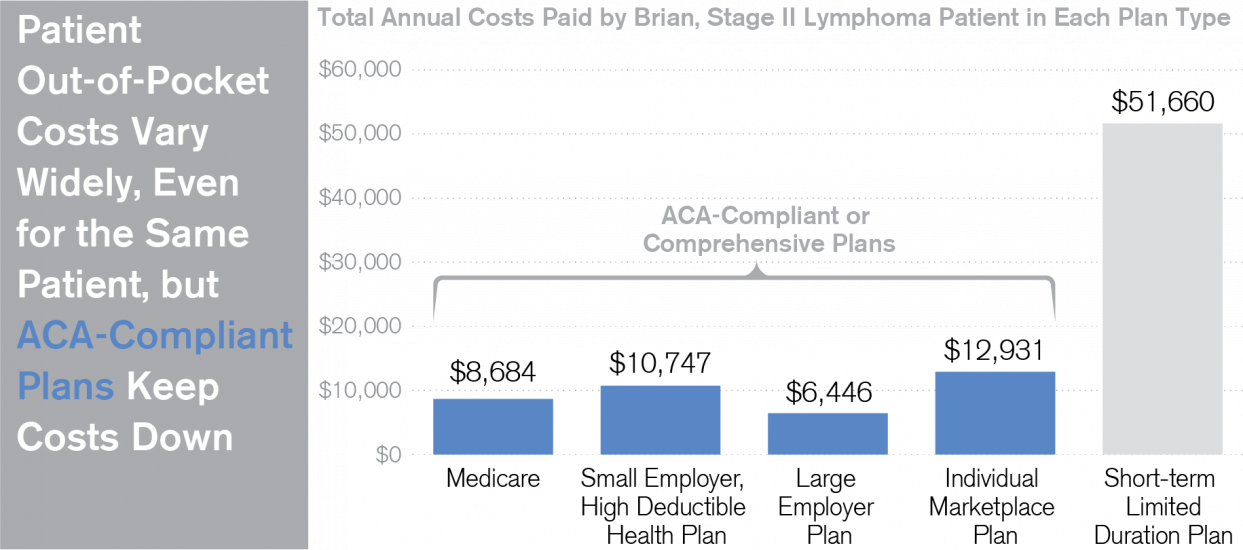

Brian has Stage II lymphoma. When he has a plan that does not include ACA protections, he pays almost 5 times as much. Maintaining the ACA’s critical patient protections and making sure these protections apply to as many people as possible is crucial to keeping costs affordable for cancer patients.

ACS CAN Fights for Solutions

ACS CAN strongly supports the continuation of the patient protections in the ACA and opposes any efforts to dismantle the legislation without replacing these protections. ACS CAN also urges policymakers to consider prohibiting or limiting the availability of short-term limited duration and other non-ACA compliant plans, or requiring these plans to follow ACA rules.

The Costs of Cancer report uses hypothetical scenarios of typical cancer patients like Brian to show what patients pay and their challenges affording care. Read more about Brian, the costs of his cancer care, and policy solutions to keep costs down.