The Problem

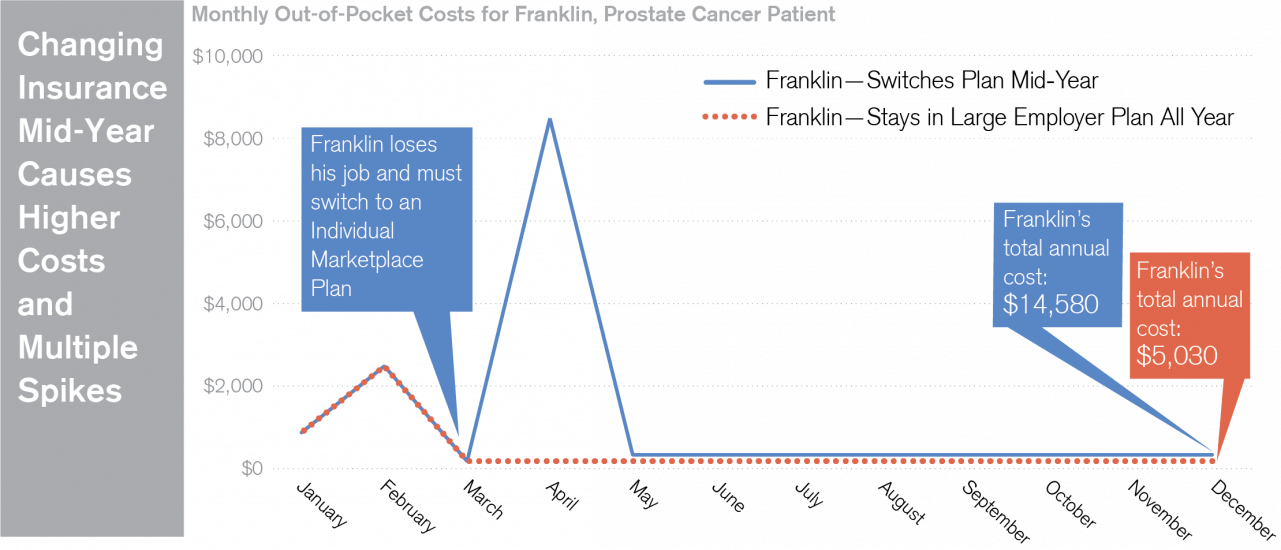

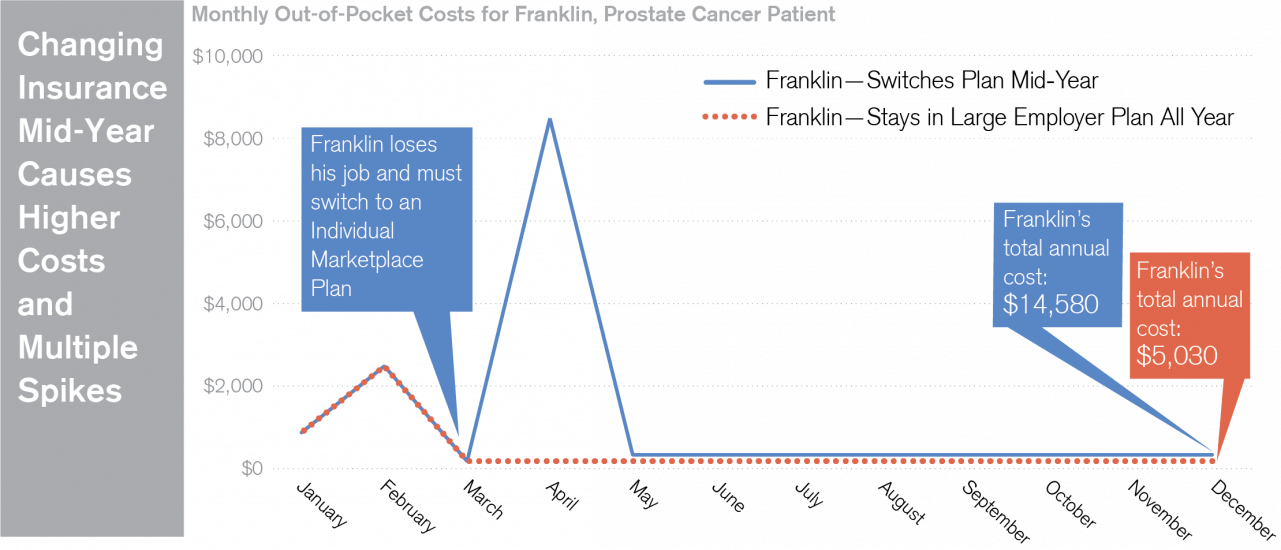

The upheaval to the U.S. economy caused by the pandemic has resulted in many Americans losing their jobs and their employer-provided health insurance. Mid-year coverage disruptions are costly because cancer patients like Franklin who have already met their deductible and maximums near the beginning of the year must pay another deductible and reach their new maximum out-of-pocket amount when they start their new insurance plan. And this problem is disproportionately affecting people of color, who are losing their jobs at higher rates than white workers during the pandemic.

Franklin, who has prostate cancer, already spent $3,000 on his cancer treatment when he lost his job in layoffs related to COVID-19. Starting a new plan cost him another $8,000 to pay his new deductible and out-of-pocket maximum. By the end of the year, Franklin will have spent almost 3 times more on his health care than he would if he’d been able to stay on his employer’s plan.

Insurance disruptions aren’t the only cost of COVID-19 for cancer patients. The pandemic has also resulted in delayed or canceled appointments, which can allow a patient’s cancer to grow, leading to higher treatment costs and worse health outcomes.

ACS CAN Fights for Solutions

ACS CAN is surveying cancer patients to understand how the pandemic is affecting them and advocate on their behalf. Learn more about their experiences at fightcancer.org/survivor-views.

The Costs of Cancer report uses hypothetical scenarios of typical cancer patients like Franklin to show what patients pay and their challenges affording care. Read more about Franklin, the costs of his cancer care, and policy solutions to keep costs.